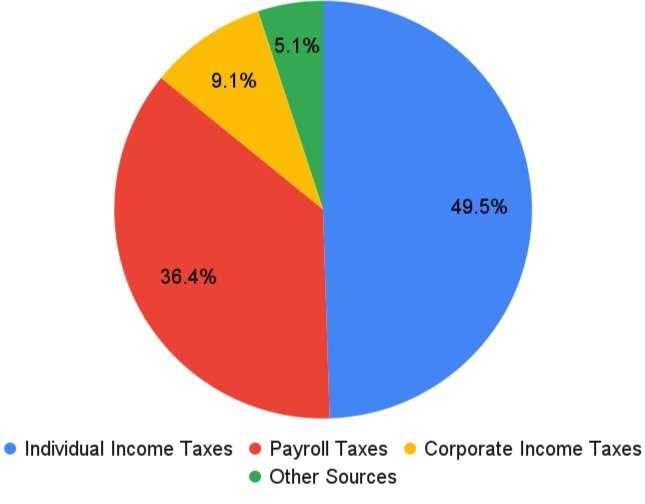

Last year, Americans paid roughly $6.5 trillion in taxes across federal, state, and local levels of government; $4.4 trillion of that revenue went to the federal government. Nearly half of Uncle Sam’s federal fundraising comes from personal income taxes, with just over a third coming from payroll taxes (see key terms below).

Federal Government Revenue by Source in 2023

Source: Congressional Budget Office, Budget and Economic Outlook: 2024 to 2034

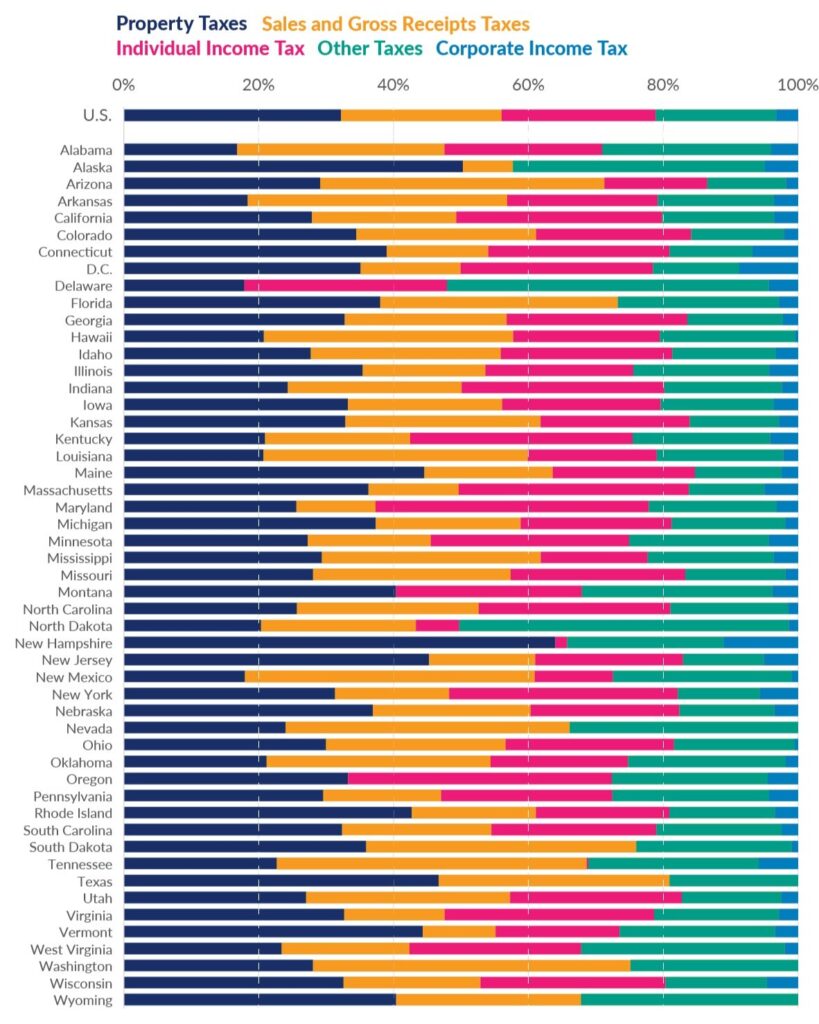

On the state level, most money comes from income taxes, though Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t have a state income tax. Sales tax is the second-largest source of state revenue.

Sources of State Tax Collections by State in 2020

Source: U.S. Census Bureau, Tax Foundation calculations

On the local level, most government revenue comes from property taxes (72% in 2024).

Uncle Sam spends about $2 trillion more annually than he receives in revenue; this difference is the much-discussed “deficit.” Congress is responsible for raising or lowering federal taxes and deciding how much the federal government spends, with disagreements leading to gridlock and potential government shutdown (on what feels like a regular basis).

Both Sides

Republicans generally favor lower taxes, believing money is better spent and more impactful in the hands of private citizens. They argue that reducing taxes for individuals and companies will incentivize them to bring (or keep) money in the United States instead of lower-tax countries. That money can then be used to raise wages and innovate, boosting the entire economy.

Democrats generally favor higher taxes on wealthy individuals and corporations, advocating the increased tax revenue be used to fund more social programs. They emphasize that the economy is “rigged” to benefit the ultrarich and support closing tax loopholes and instituting a minimum tax on billionaires to ensure they “pay their fair share.” They generally support maintaining or lowering taxes on the middle and lower classes.

Terms to Know

- Payroll Taxes: For most people, this is a 15.3% tax shared by employers (7.65%) and employees (7.65%) taken out of each paycheck. People who are self-employed are responsible for the entire 15.3%, often called the “self-employment tax.” Wages above $168,600 are exempt from taxes to fund social security (raises to $174,900 in 2025).

- Income Taxes: An income-based tax rate paid by employees to fund local public services like transportation, education, and defense. Most people pay both federal and state income tax, though nine states do not have a state income tax.

- Sales Taxes: A tax on the sale of goods and services at a percentage of the purchase price, determined state-by-state. Alaska, Delaware, Montana, New Hampshire, and Oregon skip statewide sales tax. California has the highest state sales tax rate.

- Property Taxes: A tax on immovable property like land and buildings and on movable, tangible personal property like cars and equipment. Property tax rates vary state by state, as does the property tax base (what is and isn’t taxable).

- Tariffs: A tax imposed by one country on goods or services imported from another country. Supporters say tariffs raise revenue, protect domestic industries, and protect national interests. Critics say they drive up prices for consumers and cause trade wars.

- Child Tax Credit: Reduces the tax bill for low- and moderate-income parents by up to $2,000 per child.

- Capital Gains Tax: Taxes owed on the profit after the sale of an asset (like real estate or stocks). Short-term capital gains taxes are paid at the same rate as ordinary income. Long-term capital gains taxes (for assets you’ve held for longer than one year) are lower than the regular income tax rate.

- Unrealized Capital Gains Tax: An unrealized gain or loss is the change in the value of a stock, bond, or other asset that has not yet been sold. Some Democrats advocate for taxing unrealized gains on ultra-high net worth individuals ($100M+).

Candidate Stances

Vice President Harris wants to raise taxes on big businesses and Americans making $400,000 or more annually, pushing President Biden’s 2025 budget plan forward. She has promised not to raise taxes on families making less than $400K, saying the middle class will keep more of their income through Child Tax Credits; she proposes $3,600/child with a bump to $6,000 for newborns. Harris has echoed Trump’s proposal to exempt tip income from taxation.

Former President Trump has proposed trillions in tax cuts. Trump has promised to expand the tax cuts he enacted in 2017 (set to expire in 2025) and shave at least one percentage point off corporate taxes. He says the loss of revenue will be paid for by higher growth and tariffs on imports—a cornerstone of his economic policy. Trump believes 10-20% tariffs on foreign goods (up to 60% on Chinese goods) will incentivize American manufacturing and create jobs. He proposes a child tax credit of $5,000/child and exempting tip income from taxation.

Eternal Perspectives

No matter your stance on tax policy, Christians are called to manage their own finances wisely and to live generously, giving to those in need. Pray for guidance in doing both, and reach out to your local church to see where help is needed.

“Don’t neglect to do what is good and to share, for God is pleased with such sacrifices.”

Hebrews 13:16 (CSB)

This is part of our Election Collection articles series, created to help Christians grow in understanding and compassion on key issues surrounding the 2024 presidential election.

Last Updated: September 24, 2024